Wills and Property Ownership and the effect on Residential Care Subsidies

There are two types of property ownership and depending on your personal circumstances and other assets or debts, in circumstances where you are needing to have full time care in a Residential Care Facility, you can protect half the value of your property, simply by the means in which you own the property.

JOINT TENANTS

If you own a property as joint tenants, the property is transferred to the survivor with only the need for a death certificate. That is not a reason though, to not have a Will.

TENANTS IN COMMON

The alternative means of ownership is tenants in common as to a share in the property. Two or more parties can own a property in shares which do not need to be equal. For this exercise we will use equal shares. The result of this is that if one of two owners dies, the deceased’s share is transferred to their executor(s) to hold on behalf of the estate and is dealt with in terms of the deceased’s Will. The survivor continues owns the other one-half share.

The benefit of this type of ownership is that a one-half share is always protected from any ‘means testing’ which the survivor may have to complete, in respect of for any type of government subsidy in the future, as the survivor only needs to include ½ share of the value of the property, not the full value.

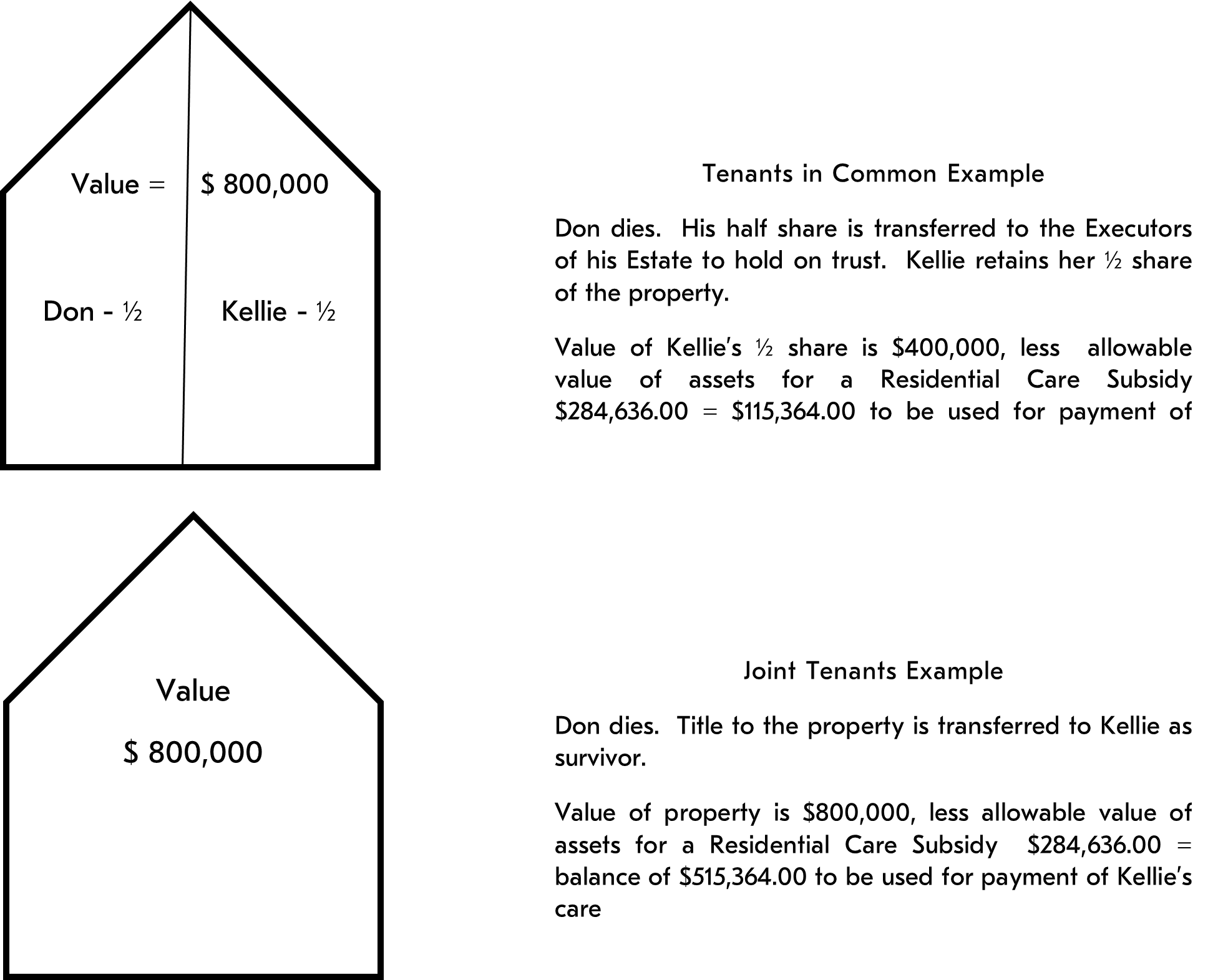

In this example we use a property value of $800,000.00 and presume there are minimal other assets.

Joint Tenants

On the death of one of you the survivor owns the whole property at value of $800,000.00. If the survivor were to complete a means test for a Residential Care Subsidy, (“RCS”) their assets would include the full $800,000.00. Currently the RCS sits at $284,636.00. All funds/assets the survivor owns over $240,000.00 are required to pay for their care. That’s $515,364.00 (presuming they live that long!), plus any money in investments or bank accounts etc.

Tenants in Common (say 1/2 share each)

On the death of one party the deceased’s share is transferred to the executor(s) of their estate and the survivor retains their own share. The property is therefore owned ½ half ($400,000) by the survivor and half by the estate ($400,000). The survivor’s assets therefore would only include $400,000 and with a RCS at $284,636.00 only $115,364.00 would be spent on care fees. Leaving the balance of the survivors share of the property $284,636.00 plus the whole share of the deceased’s estates share, $400,000.00 total $684,636.00, left for the residuary beneficiaries.

HOW YOUR WILL COMES INTO THIS

The survivor still retains ‘possession’ and control of the property in practical terms as in each of owners Wills you leave the survivor a ‘life interest’ in the share of the property. This allows the survivor to remain living in the property (or sell it in substitution of another), during the survivor’s lifetime (or until they enter another relationship).

This is only one example of how the way in which you own your property may affect your ability to claim a Residential Care Subsidy and consequently protect your assets from means testing.

Please call Michelle, who will be happy to discuss your own situation.